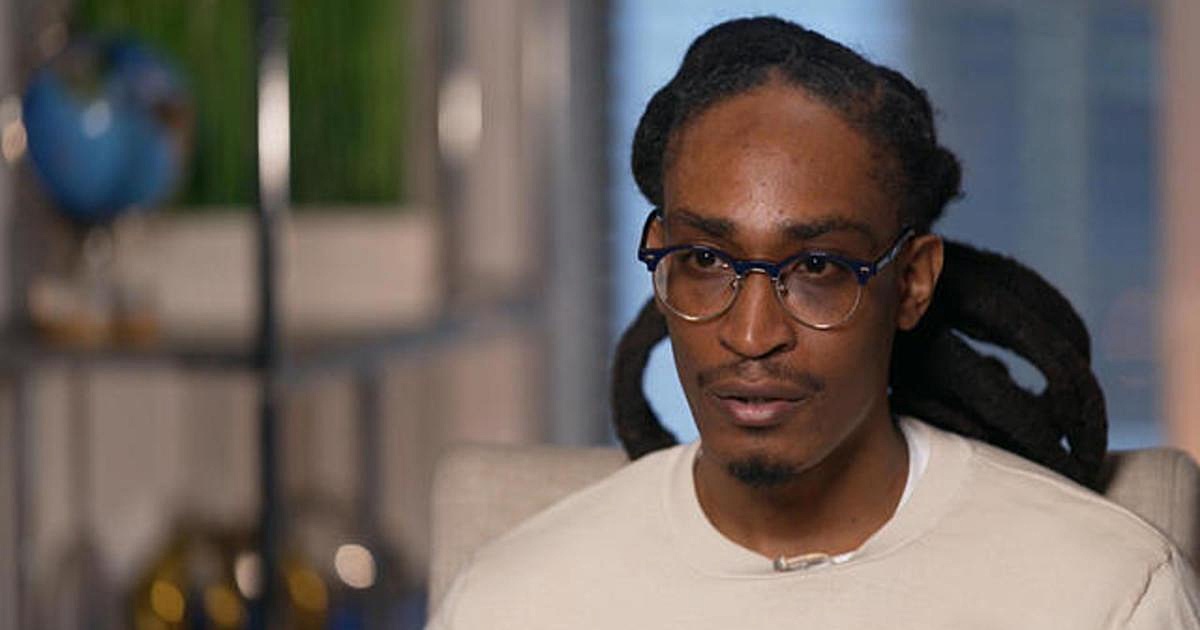

President, Association of Asset Custodians of Nigeria, Mr Abiodun Adebimpe, provided insights into Nigeria’s current economic landscape and discussed the upcoming annual conference of the association. The following are extracts from the interview:

Thank you for taking the time to have this conversation. How would you describe the current Nigerian economic landscape in a few words?

The current situation in Nigeria can be described as tough, challenging, and full of difficulties. Major economic indicators show a grim outlook characterized by soaring inflation rates, high food prices, massive importation, plummeting crude oil prices, weakened Naira, higher cost of refined petroleum products, unemployment, infrastructural deficit, and insecurity.

These factors contribute to an unstable environment plagued by hunger and poverty. The recent protests in August against bad governance highlight the potential for social unrest if the situation does not improve. Nigeria, being a youthful nation, cannot sustain high unemployment rates and low wages without risking peace and stability.

Despite these challenges, there are reasons for optimism. The current government has implemented bold economic reforms on both fiscal and monetary fronts which are expected to have positive impacts on the welfare of the people.

You and your association advocate for a market-friendly economic environment. Do you believe the current government is working towards achieving this?

The market-friendly economic environment we advocate is still idealistic and requires proper planning and execution. It involves creating the right structures and environment for the private sector to thrive and make business decisions without hindrance. Nigeria, as it stands, still heavily relies on government funding and direction.

However, the current administration has launched several policies to remodel and stabilize the economy. While the outcomes have been mixed, it is an ongoing process that requires continuous efforts. Reforms such as the removal of fuel subsidy and unification of currency exchange rates aim to reduce drain on revenue and engender a competitive market. The efficacy of these policies is yet to be fully realized.

The Nigerian Naira has significantly depreciated against the US Dollar due to an unpredictable foreign exchange market and dwindling revenue. How do you assess the Central Bank of Nigeria’s management of the FX market?

The Nigerian Naira’s depreciation is a result of global market instability and dwindling revenue from crude oil sales, which heavily impacts Nigeria’s foreign exchange earnings. The Central Bank of Nigeria (CBN) has implemented various policies to stabilize the exchange rate, including unifying the multiple exchange markets and adopting a market-driven exchange rate.

While progress has been made in stabilizing the Naira, its real value against the US Dollar remains a topic of debate. The continuous management of the FX market by the CBN is crucial in ensuring price stability and addressing the challenges faced by the economy.

Inflation has been a major concern in Nigeria. What tips do you have for the CBN in managing interest rates going forward?

Inflation in Nigeria has been driven by various factors such as high energy and food prices, insecurity, and currency devaluation. The CBN has employed monetary policies, including hiking interest rates, to combat inflation. However, a medium to long term approach is required to address the root causes.

Increasing local production of food items, curbing expenditure on education and medical treatment abroad, and prioritizing small and medium-sized enterprises (SMEs) can help alleviate inflationary pressures. Additionally, strategic reforms and investments in agriculture and industrialization will be key to unlocking Nigeria’s full economic potential.

Some argue that Nigeria is not ready to embrace virtual currencies and play in the crypto market. What are your thoughts on this?

While Nigeria introduced the e-Naira as a central bank digital currency, recent issues with crypto exchange platform Binance have shifted the landscape. The Central Bank of Nigeria and the Securities & Exchange Commission are working on regulatory measures for digital currencies and assets.

However, the crypto market is globally accepted and cryptocurrencies like Bitcoin and Ether have become popular. Nigeria has a significant presence in the cryptocurrency market, but the suspension of cryptocurrency firms by the government has both advantages and disadvantages in stabilizing the Naira and foreign exchange market.

How would you assess the ease of doing business, protection of investments, and the development of the capital market in Nigeria?

The government and regulatory agencies are making efforts to create a conducive business environment in Nigeria. While fundamental elements for investment exist, challenges such as inadequate infrastructure, power supply, and insecurity need to be addressed. The government is aware of these hindrances and strategic reforms are required to unlock Nigeria’s economic potential.

The COVID-19 pandemic accelerated technological solutions and innovations. In what areas do you think further enhancements are needed in your industry?

The banking industry has experienced increased innovation and digitization, driven by the growing demand for modern banking services. COVID-19 accelerated this trend, leading to operational shifts across sectors. Further enhancements are needed in areas such as digital banking, customer experience, and cybersecurity to ensure the industry stays aligned with global advancements.

Do you still believe that the Nigerian economy has adapted to evolving changes and has strong fundamentals?

To a large extent, the Nigerian economy has adapted to evolving changes and possesses strong fundamentals. Nigeria’s population, natural resources, and potential for growth make it an attractive investment destination. However, structural obstacles such as inadequate infrastructure and insecurity need to be addressed to unleash its full economic potential.

What is the current state of the Nigerian custody industry in terms of investor confidence and asset safety?

The Nigerian custody industry has recovered from the disruptions caused by the COVID-19 pandemic and regained stability. As part of the capital market ecosystem, the industry ensures the safety of investor assets and offers best-in-class services.

Regarding the Nigerian Investors Conference, what can participants expect in this year’s edition?

The Nigerian Investors Conference 2024 will be held in London under the theme “Nigeria: Open to the World.” The conference aims to highlight the Nigerian capital market as a key driver of economic development and showcase the positive impact of political transitions. Keynote speakers, such as the Deputy Governor of the Central Bank of Nigeria, will discuss monetary policies and attracting foreign investment in the capital market. The conference serves as a platform for knowledge enhancement, boosting investor confidence, and networking.

AACN is celebrating its 15th anniversary this year. How has the association evolved over the past 15 years, and what are its goals for the future?

Over the past 15 years, AACN has grown from five to eleven member institutions. The association has played a significant role in making the Nigerian Capital Market more suitable for investors and promoting global best practices. AACN has collaborated with regulatory bodies, introduced guidelines for custody of financial instruments, and actively participated in various committees and planning bodies. The association’s goal for the future is to remain relevant and continue aligning with global best practices.

Has the association been involved in any CSR projects?

AACN actively participates in supporting community initiatives and mentoring students in government-owned schools in Lagos State. The association believes in giving back to the community and making a positive impact on individuals.

How does AACN plan to commemorate its 15th anniversary? Are there any special events or activities scheduled?

AACN is currently planning activities to commemorate its 15th anniversary, and the capital market will be notified once the plans have been finalized.

Discover more from Tension News

Subscribe to get the latest posts sent to your email.