In addition to that, they can also provide assistance with debt consolidation, enabling you to replace multiple existing debts with a single one that carries a lower interest rate.

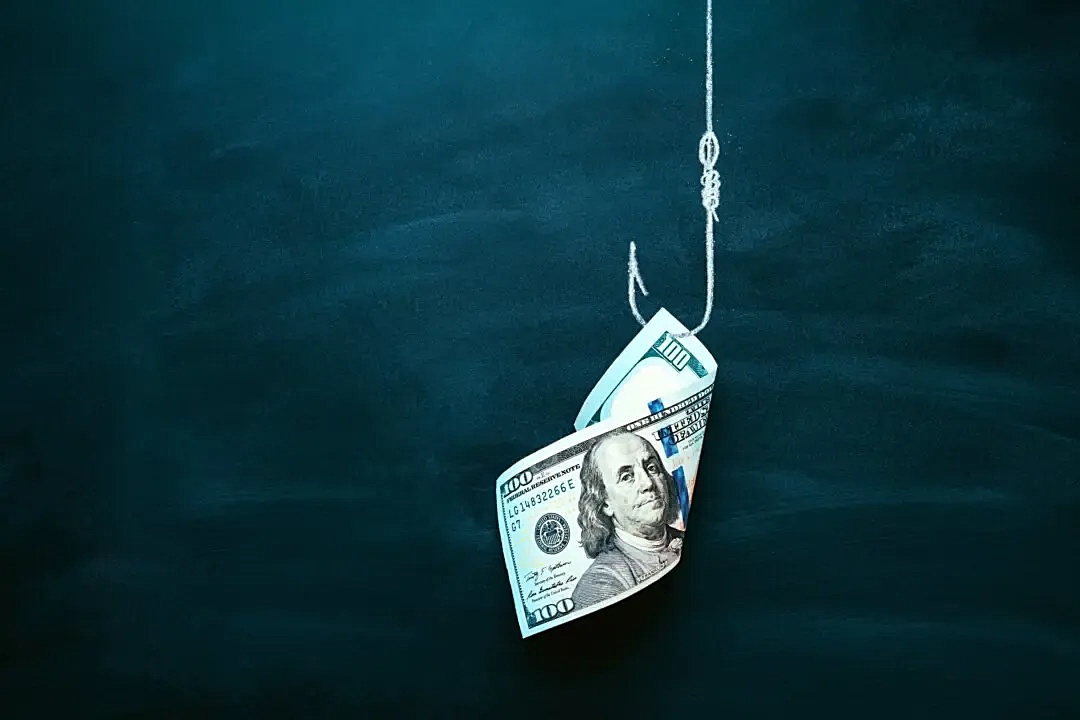

It is important to note that a legitimate company would never make such claims, especially since they don’t have knowledge of the full extent of your debt.

On the contrary, a fraudulent company may offer to enroll you in their program without even taking a look at your financial documentation beforehand.

Furthermore, beware of scammers who deceitfully claim that the fees you pay are actually being used to repay your creditors. However, in reality, these fraudulent companies pocket the money for themselves.

A reputable company, on the other hand, will only invoice you once they have successfully settled your debt. Usually, they charge a commission based on the amount of debt relief achieved, although some may also apply a small monthly fee.

It’s worth noting that legitimate companies will only invoice you once they have fully completed the promised services.

If you have any doubts or concerns, do not hesitate to make a phone call. Not only will this save you money, but it will also protect you from falling victim to a scammer.

Similar caution should be exercised when dealing with credit repair companies. In reality, there is often no need to engage their services in order to dispute any inaccurate or outdated items on your credit report. You can easily contact any of the major credit bureaus directly, as they readily welcome and facilitate the correction of erroneous information.

Remember, you have the ability to rectify these issues on your own, so it is wise not to take unnecessary risks by falling prey to scammers.

Discover more from Tension News

Subscribe to get the latest posts sent to your email.